CHINESE investment in

Australian commercial property has more than doubled in the past year, with more than $2.5 billion invested.

But with a number of major Chinese developers still vying to enter the market, and as Chinese insurance companies flag a willingness to begin overseas investment, that figure is set to hit a record high in the next year.

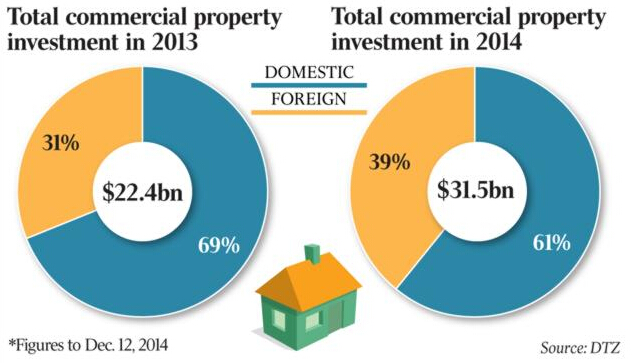

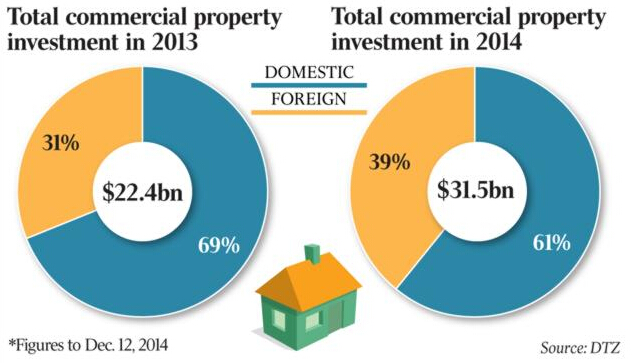

Figures compiled by The Australian from property services firm DTZ show that $12.176bn has been invested across the office, retail, industrial and mixed-development sectors in the year, compared with $6.882bn in 2013. Office investment from China and Hong Kong totaled $2.506bn for the year, compared with $954 million last year, with major players including Country Garden, China Poly Group and R&F Properties aggressively purchasing development sites and offices in Sydney and Melbourne.

Other major Chinese developers, including Shenzen-based China Merchants, Jiangsu Future and Gemdale, are trying to enter the market.

CBRE director Mark Wizel said residential developments had been the favoured asset class to date, although this would change over time as Chinese companies became more comfortable with the local market.

“Hotels will be the first beneficiary of the active capital due to the fact that a lot of buyers coming from China understand the metrics of how a hotel operates and just need to apply local market drivers to the asset itself,” he said.

“We have seen a major uplift in interest from private Chinese buyers wanting to enter the retail shopping centre market as well and this is another key area we feel will grow in 2015.”

There are more deals close as the year comes to an end.

China’s Dalian Wanda Group, headed by one of China’s richest businessmen, Wang Jianlin, is finalizing its purchase of the

Gold Fields House office building fronting Sydney’s Circular Quay, ¬although a deal has not yet been done. The harbourside building, which has drawn an offer of more than $400m from Wanda, is controlled by Blackstone and a group of pension funds, and could be converted into a $1bn luxury apartment tower.

The deal, first flagged in The Australian last month, is being led by real estate firms CBRE and JLL, which declined to comment.

Meanwhile, Chinese-backed developer Vision Investment Group is nearing the purchase of an office building at 338 Pitt Street from AMP Wholesale Office Fund for more than $104m.

VIG bought another building on the same block, at 233 Castle¬reagh Street, in November for $156m. It is understood that the group plans a major apartment and hotel project on the site in a joint venture with Chinese-backed developer AXF Group.

Gemdale, Shinmao Property and Greentown China Holdings will all be key players in capital city markets next year, said Mr Wizel, who this month brokered a $22m deal in Southbank.

“We feel that a lot of the private families and high-net-worth individuals will shift away from residential development and will have more of a focus on investment-grade assets,” he said.

Already, Shanghai-based conglomerate Fosun International, which recently completed the acquisition of local oil and gas firm Roc Oil for $439m, is nearing a deal to purchase an Investa Property Group-owned tower in North Sydney for $120m.

Despite the rise in Chinese investment, that figure remains considerably below the single biggest source of capital, Singapore, which this year accounted for 36 per cent of total investment across office, retail, industrial and mixed-use markets, according to the DTZ analysis.

More than $4.423bn in Singaporean capital flowed into Australian property this year, an increase from $1.861bn last year, although the 2014 figure was augmented by the $2.6bn takeover of Australand Property Group by Singapore’s Frasers Centrepoint.

Additional capital could come from Chinese insurance companies, which have so far been reluctant to invest overseas.

Sunshine Insurance became the first Chinese insurance group to invest directly in Australian property, purchasing Sydney’s Sheraton on the Park in November for $463m.

Of China’s 20 biggest insurance companies, only four have already invested overseas real estate, while another eight — including China’s second-largest insurer, PICC — have flagged an intention to invest offshore.

While nine of China’s biggest developers have already made offshore investments, another eight hope to in the coming year.

While JLL did not forecast ¬future foreign investment growth, Stephen Conry, the agencies chief executive, said there were a number of offshore investors formalizing their investment strategies and hoping to make acquisitions in the next 12 months.

“Often the capital is broadly focused on Sydney and Melbourne, although Brisbane and Perth are again more attractive opportunities and decentralization to non CBD markets is remaining strong,” Mr Conry said.

But recent acquisitions by Chinese companies “appear to be ¬tentative, quasi-experimental investments,” according to a recent Cushman & Wakefield publication. “(These) investments (are) designed not so much to make money, (but) as to learn the ropes of overseas markets,” the analysts wrote.

“Having made fortunes in the boom years of Chinese real estate, many investors are now over-¬reliant on the performance of the Chinese market, with little to hedge against a decline.”

A 25 per cent appreciation of the yuan has also boosted the buying power of Chinese investors driving more outbound direct investment into developed markets, the report found.

Please

contact us in case of Copyright Infringement of the photo sourced from the internet, we will remove it within 24 hours.

Figures compiled by The Australian from property services firm DTZ show that $12.176bn has been invested across the office, retail, industrial and mixed-development sectors in the year, compared with $6.882bn in 2013. Office investment from China and Hong Kong totaled $2.506bn for the year, compared with $954 million last year, with major players including Country Garden, China Poly Group and R&F Properties aggressively purchasing development sites and offices in Sydney and Melbourne.

Figures compiled by The Australian from property services firm DTZ show that $12.176bn has been invested across the office, retail, industrial and mixed-development sectors in the year, compared with $6.882bn in 2013. Office investment from China and Hong Kong totaled $2.506bn for the year, compared with $954 million last year, with major players including Country Garden, China Poly Group and R&F Properties aggressively purchasing development sites and offices in Sydney and Melbourne.