Nine Reasons To Invest In Texas

While making presentations across Texas, Real Estate

Center researchers frequently are aware of high-networth

investors in the audience. These people may

live in New York City, Miami or San Diego, but they invest in

Texas real estate.

Why do investors find Texas so attractive?

Let us count the reasons:

(1) Texas is leading the United

States in the current economic recovery,

(2) Texas' economy is

big and growing,

(3) Texas' economy is profitable,

(4) Texas has

a growing population,

(5) Texas' economy is an international

economy,

(6) the tax burden is less in Texas,

(7) Texas has an affordable

housing sector,

(8) Texans have entrepreneurial spirit,

and

(9) Texans are mobile.

1.Texas Leading Nation in Economic Recovery

The Great Recession ended in June 2009, according

to the Business Cycle Dating Committee of the

National Bureau of Economic Research. The committee

noted that "a trough in business activity

occurred in the U.S. economy in June 2009. The

trough marks the end of the recession that began

in December 2007 and the beginning of an expansion."

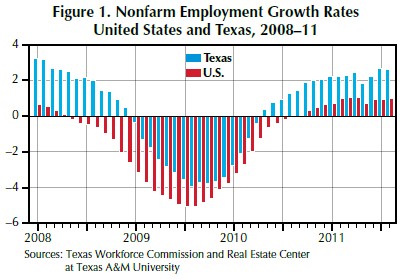

The Texas economy suffered less in terms of lost jobs and

outputs in the Great Recession than the nation as a whole

(Figure 1). The duration of the recession, measured by the number

of months of job losses, was shorter for Texas while the

intensity, measured by the highest job loss rate in the trough

month, was smaller for Texas than for the nation.

While the U.S. economy experienced its first month of

job losses in May 2008, Texas continued to create jobs for

eight more months, until January 2009 (Figure 1). The state's

economy posted job losses for 16 months, from January 2009

to April 2010.The largest year-on-year annual job loss rate for the United States was 5.1 percent in August 2009;

it was 4 percent for Texas that month.

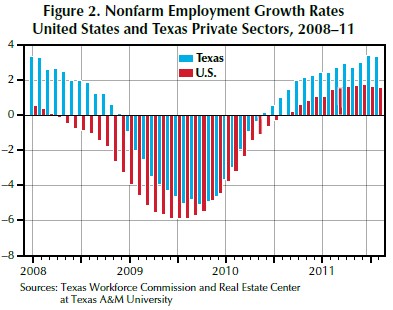

The state's private sector suffered 17 months of job losses

with a trough of 5 percent job loss in August 2009 compared

with 28 months of job losses and a trough of 5.9 percent in

June 2009 for the nation (Figure 2).

Academics and policy makers will be debating the

causes of the Great Recession for many years. Increases

in the Federal funds rate from 1 percent in 2003

to 5.2 percent in 2007, the increase in international crude

oil prices from $20 per barrel in 2001 to more than $130 per

barrel in 2008, the housing price bubble, misguided macroeconomic

policies, and the collapse of the U.S. financial system

have all been suggested.

Whatever the causes, consumers and producers responded to

the recession by postponing their investment and consumption

plans and waiting for signs of economic improvements. After

all, past economic recessions and depressions have ended in periods

of economic recovery, and the recent recession, no matter

how deep, is not an exception.

The postponement of investment and consumption has

created pent-up demand for goods, services and quality investments,

not just for distressed properties. In the short run,

meeting this demand for goods and services can lead to a consumption

boom, resulting in more investments in various parts

of the U.S. economy. If this leads to more employment, that

is, if employers increase output by employing more people,

then the short-run gains in the economy can lead to economic

growth in the long term.

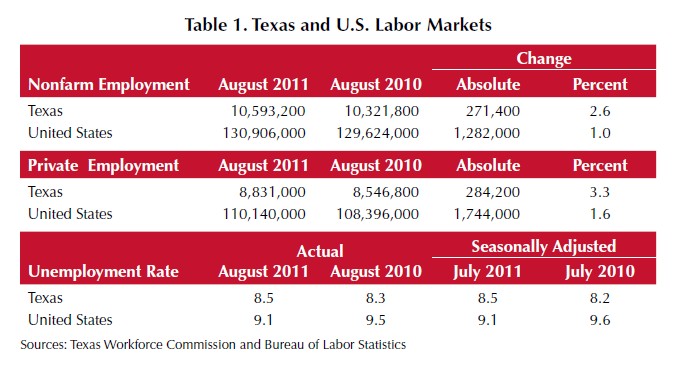

Several indicators suggest that Texas is a promising region

for more investment, economic growth, and higher profitability

thanks to a combination of favorable human resources,

natural resources and its legal and policy environment. The

state's economy proved resilient in the Great Recession, and

now is leading the U.S. economic recovery. From August

2010 to August 2011, the U.S. economy added 1,282,000 jobs,

271,400 of which, or 21.1 percent, were generated in Texas

(Table 1).

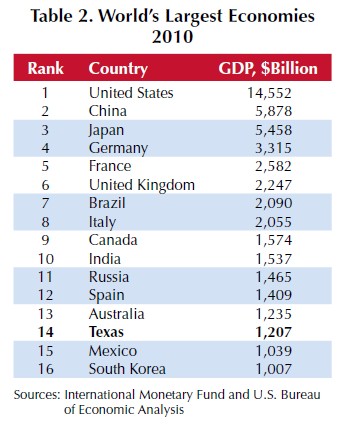

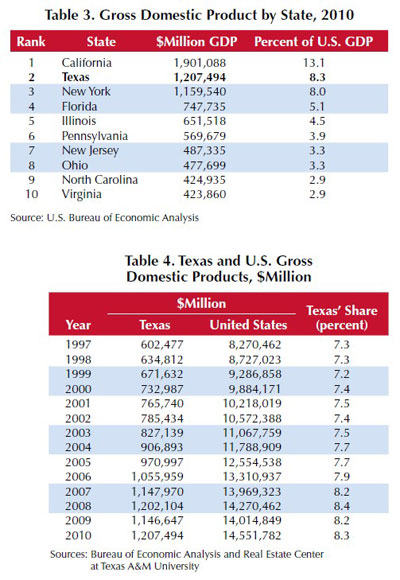

2.Texas' Economy is Big and Getting Bigger

With a gross domestic product (GDP) of more

than $1.2 trillion, Texas' economy was the 14th

largest in the world in 2010 (Table 2). It was the

second largest economy in the nation in 2010,

larger than New York's (Table 3). The state's GDP

accounted for 8.3 percent of U.S. GDP compared

with 13.1 percent for California and 8 percent for New York.

A growing economy offers more job opportunities and

attracts more population, leading to further growth in the

regional economy. By offering more investment opportunities,

a growing economy can further promote growth and development.

Revenues generated by a growing economy enable local

and state government to impose lower taxes.

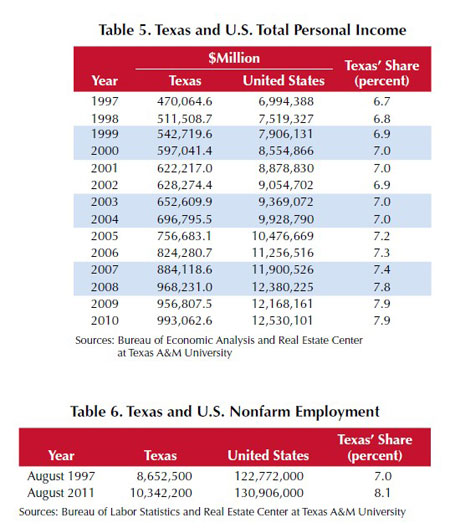

Texas' share of U.S. GDP increased from 7.3 percent in 1997

to 8.3 percent in 2010 (Table 4). The state's share of total personal

income (wages, salaries, interest and dividend incomes)

generated in the U.S. increased from 6.7 percent to 7.9 percent

during that period (Table 5).

Higher output growth rates mean more jobs. Texas' share of

the nation's nonfarm employment increased from 7 percent in

August 1997 to 8.1 percent in August 2009 (Table 6).

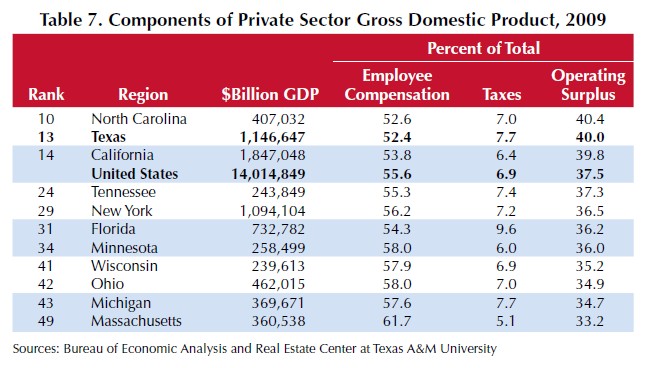

3.Texas' Economy is Profitable

An economy's profitability on a macro level can

be measured in terms of a macro profit margin.

Private sector GDP consists of compensation of

employees, taxes and subsidies, and gross operating

surplus (profits). The percentage of private sector GDP accounted for by gross operating surplus is an important

indicator of profitability of an economy.

In 2009, gross operating surplus in Texas

accounted for 40 percent of the state's private

sector GDP compared with a national average

of 37.5 percent (Table 7). This means Texas

businesses are more profitable.

4.Texas' Population is Growing

A growing population, particularly

if well educated and

sporting an entrepreneurial

spirit, is an important part of the

economic infrastructure. On the

demand side, a growing population

boosts the need for goods and services,

especially housing units, which in turn leads to

more economic growth and higher profitability.

On the supply side, population is the source of labor inputs

for an economy. A growing population means the availability

of more labor inputs and fewer constraints on economic

activities.

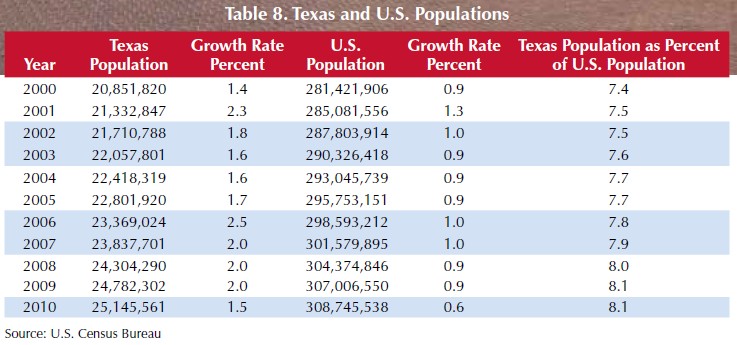

The share of U.S. population

living in Texas has increased from

7.4 percent in 2000 to 8.1 percent

in 2009 (Table 8). Population studies

at the Real Estate Center have

shown that the annual growth

rate of the state's population is expected

to exceed the national average

in the foreseeable future. State

demographers have estimated that

the Texas population could grow

by 12 million from 2010 to 2030.

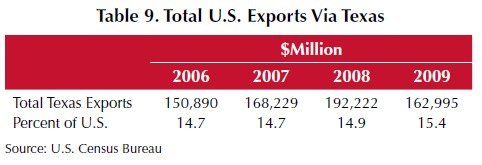

5.Texas' Economy is International

Texas is an important player in the nation's international

trade. Total exports via Texas in 2009

were nearly $163 billion, accounting for 15.4

percent of U.S. exports (Table 9).

The state alone exported more than $1 billion

to 25 countries in 2009. Mexico received 34.4

percent of Texas exports in 2009 followed by

Canada (8.5 percent) and China (5.5 percent).

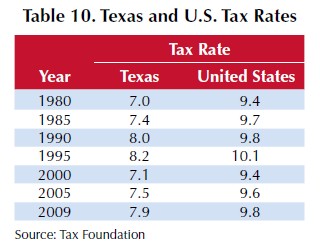

6.Tax Burden is Less in Texas

In 2009, state and local taxes paid by Texans accounted

for 7.9 percent of the state's per capita

income, compared with 9.8 percent for the nation

(Table 10).

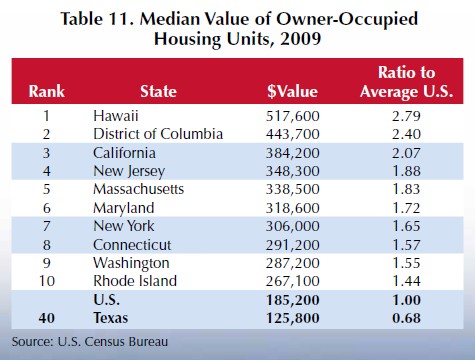

7.Texas Has Affordable Housing

The average price of an owner-occupied housing

unit in Texas in 2009 was $125,800, about

68 percent of the national average (Table 11).

Affordable housing is an important factor in

attracting population to the state and expanding

the state's economy. The lower cost of living

allows wages to be lower, which helps Texas

businesses remain globally competitive.

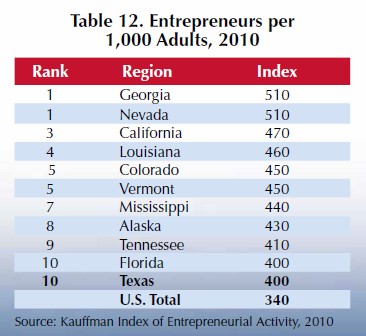

8.Texans Have Entrepreneurial Spirit

New business creation and expansion of existing

businesses through innovation and creativity

drive economic growth. The percentage of

adult, nonbusiness owners who start a business

each month is a significant measure of entrepreneurial

activity. Another key measure is

the number of entrepreneurs per 1,000 adults

(Table 12).

According to the Kauffman Index of Entrepreneurial Activity,

Texas ranked tenth in entrepreneurial activity (400 per

Table 11. Median Value of Owner-Occupied 100,000 adults) in 2010 compared with 340 for the nation.

9.Texans are Mobile

Free movement of labor and capital not constrained

by language and cultural barriers in

various regions of the U.S. economy promotes

balanced economic growth and development.

One measure of labor mobility is the percentage

of people one year or older who lived in a different

house in the United States one year ago.

In 2009, about

17.4 percent of

Texans one year

and older lived

in a different

house one year

ago compared

with 14.9 percent

for the nation

(Table 13).

High mobility makes it easier for people to move away from

places with fewer economic opportunities to places where opportunities

are greater.

Texas is Built for Business

Texas is an attractive place for real estate investors. It works hard

to stay "business friendly," and the state's economic environment

supports businesses as they compete in the global economy.

| MAYS BUSINESS SCHOOL | |

| Texas A&M University | http://recenter.tamu.edu |

| 2115 TAMU | 979-845-2031 |

| College Station, TX 77843-2115 | |

Advisory Committee

Joe Bob McCartt, Amarillo, chairman; , Mario A. Arriaga, Spring, vice chairman; Mona R. Bailey, North Richland Hills; James Michael Boyd, Houston;

Russell Cain, Fort Lavaca; Jacquelyn K. Hawkins, Austin; Kathleen McKenzie Owen, Pipe Creek; Kimberly Shambley, Dallas; Ronald C. Wakefield, San Antonio;

and Avis Wukasch, Georgetown, ex-officio representing the Texas Real Estate Commission.

Tierra Grande (ISSN 1070-0234) is published quarterly by the Real Estate Center at Texas A&M University, College Station, Texas 77843-2115. Subscriptions

are free to Texas real estate licensees. Other subscribers, $20 per year. Views expressed are those of the authors and do not imply endorsement by the

Real Estate Center, Mays Business School or Texas A&M University. The Texas A&M University System serves people of all ages, regardless of

socioeconomic level, race, color, sex, religion, disability or national origin. Photography/Illustrations: Robert Beals II, pp. 1, 4, 6.